The Firm

Build together for all

Our story

Omnes’ roots trace back to 1999, when we were a part of the French bank Crédit Lyonnais, and then became a part of Crédit Agricole. Local impact has always been front and centre to our mission, as has our dedication to entrepreneurs.

In 2006 Omnes became the first private equity firm to launch a fund dedicated to renewable energy in France. We operated on conviction and clarity of vision: we knew that renewables were the future, and would be instrumental to creating a sustainable future.

It is that same agility and dedication to positive impact that drove Omnes to become an independent company in 2012, and that continues to drive our culture today.

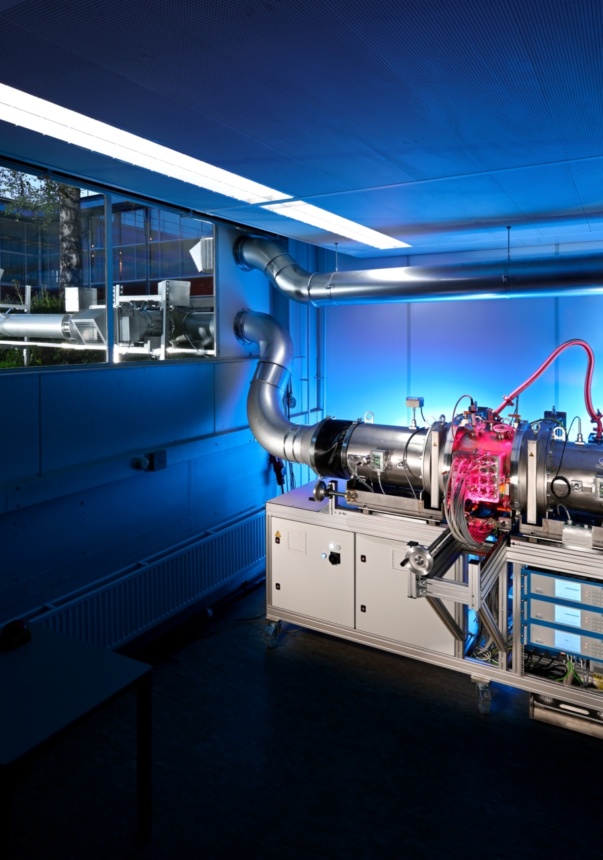

We specialise in four investment strategies, each with a focus on the energy transition: renewable energy, sustainable cities, deeptech and co-investment. To date, we have accompanied 250+ entrepreneurs, building a legacy that addresses today’s most pressing challenges.

Milestones

Crédit Lyonnais Asset Management Private Equity (CLAMPE)

CLAMPE becomes Crédit Lyonnais Private Equity (CLPE)

CLPE becomes Crédit Agricole Private Equity (CAPE)

CAPE launches its first renewable energy fund (Capenergie)

CAPE commits to support the UN Principles for Responsible Investment (UN PRI)

CAPE becomes Omnes Capital

Our values

We exist at the intersection of investors looking to have meaningful impact and entrepreneurs. At Omnes, we see performance as a virtuous cycle, where excellent returns enable greater change, on a large scale, and for the long-term; and where strong environmental, social and governance frameworks create greater trust, more opportunities, and set a benchmark for environmental leadership.

Our success and performance is built on our dedication to true partnership. We believe in providing additionality, and embark on a hands-on journey with our entrepreneurs that sets them up to outperform.

We are stewards of our investors’ capital and of our entrepreneurs’ missions. We operate on the principles of trust, transparency, resilience and self-assessment to ensure that at every step, we are making decisions that will drive the most impact.

Our clients

We have been entrusted with the capital from over 100+ institutional investors across 17 countries – representing millions of pensioners, insurance and policy holders, and independent savers – as well as that of successful entrepreneurs and business owners.

- Private and Public Institutional Investors

- Family Offices and High-net-worth Individuals

Our culture

Our people

Life at Omnes

Omnes’ first global brand ambassador

Nyck de Vries is Omnes’ first global brand ambassador, representing and championing the firm’s key corporate values: high performance and team spirit. The partnership is a testament to de Vries’ exceptional career and is aligned with Omnes’ commitment to pursue economic and environmental excellence.

The Omnes Foundation