Carbyon closes €15.3M Series A investment to demonstrate its fast-swing Direct Air Capture technology at full scale

EINDHOVEN, the Netherlands – Dutch direct air capture (DAC) startup Carbyon has secured an investment round of €15.3 million. The company has developed an innovative, patented technology to capture CO2 directly from the atmosphere. Their ‘fast swing’ technology increases CO2 capacity and thereby significantly drives down unit, energy and project costs – all critical criteria to facilitate large scale deployment. This Series A financing round brings Carbyon’s total investments to more than €25 million. The strong financial backing will allow the company to develop the first engineering-scale demonstrators, start commercial pilot testing and prepare for an ambitious scale-up.

The company welcomes three new investors to the table: Siemens Financial Services, Omnes Capital and Global Cleantech Capital who are joining existing investors Invest-NL, Innovation Industries, Lowercarbon Capital and the Brabant Development Agency (BOM). This international consortium of investors, all having a strong track record of supporting cleantech startups, have a shared urgency to combat climate change. This seamlessly aligns with Carbyon’s mission to provide a scalable, affordable and global carbon capture solution.

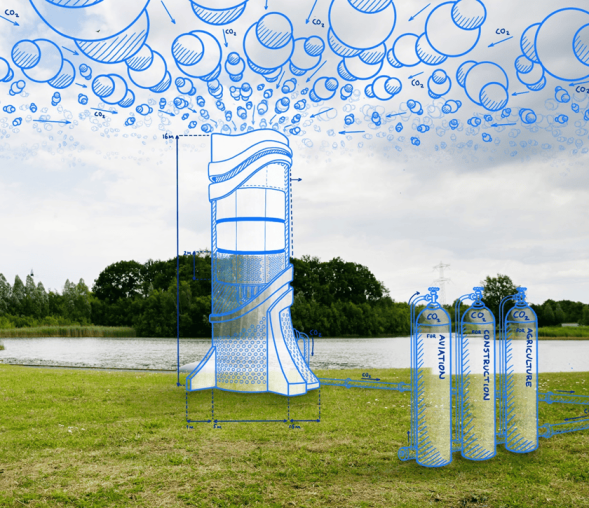

Carbyon, founded by Hans De Neve in 2019, is developing DAC machines using a patented, ultra-fast capturing technique. This high-speed process drastically reduces the costs of their DAC machines, leading to significantly lower cost-per-ton of CO2 captured.

During the past few years, the company has been perfecting their technology to prepare for scaling up. The recent financial investment will allow the company to develop the first engineering-scale outdoor demonstrators and to prepare to go to market.

The first models will be tested at the High Tech Campus Eindhoven and be shipped to pilot partners for field testing. In parallel, Carbyon will prepare to expand production to 50,000 machines per year by 2031 and continue to gigaton scale in 2050.

“This new investment brings us much more than the financial resources to continue our growth. Our partners have the required manufacturing and scaling knowledge we need to rapidly but responsibly scale our technology. This consortium is a dream scenario and is highly motivating to continue with our mission.”

“We are very pleased to be able to support Carbyon as it moves forward with the development of innovative and affordable technology to capture CO2 directly from the atmosphere. We stand ready to offer our financial expertise and access to Siemens’ broad portfolio of solutions to support Carbyon in its journey to deploy DAC systems at scale.”

About Carbyon

Carbyon develops equipment to filter CO2 from the air, to be stored underground or converted it into alternatives to fossil fuel-based products. Carbyon, founded by Hans De Neve in 2019, uses a patented, ultra-fast capturing technique to reach an industry leading low cost-per-ton of CO2 captured.

The Dutch company, spin-off from the applied research institute TNO and winner of the $1M Milestone Award of the XPRIZE Carbon Removal, is seen as one of most promising technology providers for large-scale carbon removal. Carbyon’s goal is to create affordable and scalable technology to mitigate climate change. For more information, visit carbyon.com.

About Omnes Capital

Omnes is a leading private equity firm dedicated to energy transition. With €6 billion in assets under management, our teams support long-term partnerships with entrepreneurs through our four core businesses: renewable energy, sustainable cities, deeptech and co-investment. For over 20 years, Omnes has been applying its expertise to help businesses grow in more than 15 countries, with a particular focus on sustainable development. As part of its approach as a responsible investor, the company has created the Omnes Foundation to support non-profit organisations working for children and young people in the fields of education, health, social and economic integration. www.omnescapital.com

About Siemens Financial Services

Siemens Financial Services (SFS) – the B2B financing arm of Siemens – provides financing that makes a difference. At SFS, we empower customers around the globe to access technology with purpose and increase their competitiveness. Based on our unique combination of financial expertise, risk management and industry know-how we provide tailored financing solutions – including flexible leasing and working capital products, project-related and structured financing, corporate lending, equity investments, finance advisory, as well as trade and receivables financing. With highly experienced and passionate teams in 20+ countries, SFS paves the way for industrial productivity, smart infrastructure and sustainable mobility, facilitating the energy transition and enabling high-quality healthcare. www.siemens.com/finance.

About Invest-NL

Invest-NL is the Dutch National Promotional Institute with a principal focus on providing financial solutions to businesses and projects that have a positive impact on society but face difficulties in securing financing from traditional sources. Our goal is to support the development of pioneering technologies, green initiatives, and social enterprises that contribute to the Netherlands’ leadership in sustainability and innovation. These include transitioning to a carbon-neutral and circular economy, ensuring affordable and accessible healthcare, and deep tech. https://www.invest-nl.nl/

About Global Cleantech Capital

Global Cleantech Capital (GCC) is a growth equity firm investing to scale exceptional companies into new market leaders in clean energy, lower carbon fuels, carbon removal and climate fintech to decarbonize the hard to abate sectors. GCC is based in Amsterdam and registered with the Dutch Authority for the Financial Markets (AFM).

For more information, please visit our website at www.gccfund.com and follow us on LinkedIn and Twitter, or email us at info@gccfund.com.

About Innovation Industries

Innovation Industries is a leading European deep-tech venture capital firm with over €850 million in capital under management. Innovation Industries invests in industrial technology, med-tech, and agri & food technology – focusing on deep-tech companies that can address global challenges. Its portfolio companies make impact through breakthroughs in areas such as energy-efficient photonic chips, climate-resilient seeds, safer & more efficient batteries, sensing technologies for better care, and more. www.innovationindustries.com

About Lowercarbon Capital

Lowercarbon Capital is a multibillion dollar climate fund founded by Chris and Crystal Sacca that backs kickass companies making real money slashing CO2 emissions, sucking carbon out of the sky, and buying us time to unf**k the planet. For more information, visit: https://lowercarboncapital.com.

About Brabant Development Agency (BOM)

Entrepreneurship is the driver of innovation – from sustainable food sources to a healthy future, climate-neutral energy, and developing promising key technologies. The Brabant Development Agency (BOM) ensures that startups playing a role in these fields receive the right support and funding to get off to a flying start and grow into scaleups, and that companies that aspire to go global can actually do so. Every year BOM works with dozens of companies to create this impact. BOM is an executive body of the Province of Brabant and the Ministry of Economic Affairs and Climate Policy.

“We believe Carbyon stands out with its exceptionally strong science-based technology and a unique capacity for large-scale industrialization. By significantly surpassing the previous generation of DAC technology, Carbyon’s next-gen approach makes it poised to reduce the cost of capture and contribute to global decarbonization.”

“The climate tech industry is one of the cornerstones in our investment policy. And Carbyon fits perfectly. Our Brainport region offers the perfect ecosystem and high-tech expertise to help Carbyon scale towards their full-potential. This might be the next big OEM in this region. Therefore, we are happy to be able to contribute to Carbyon’s technology development”